Multibanking

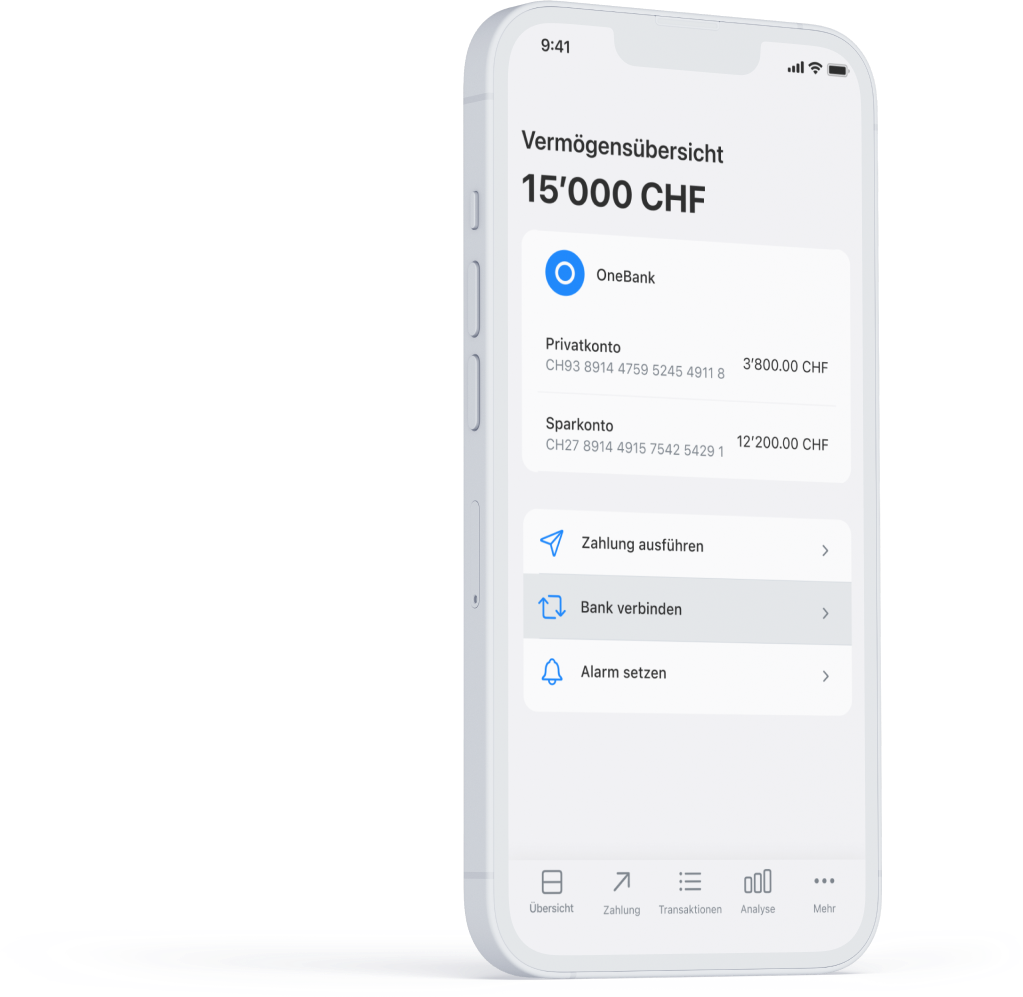

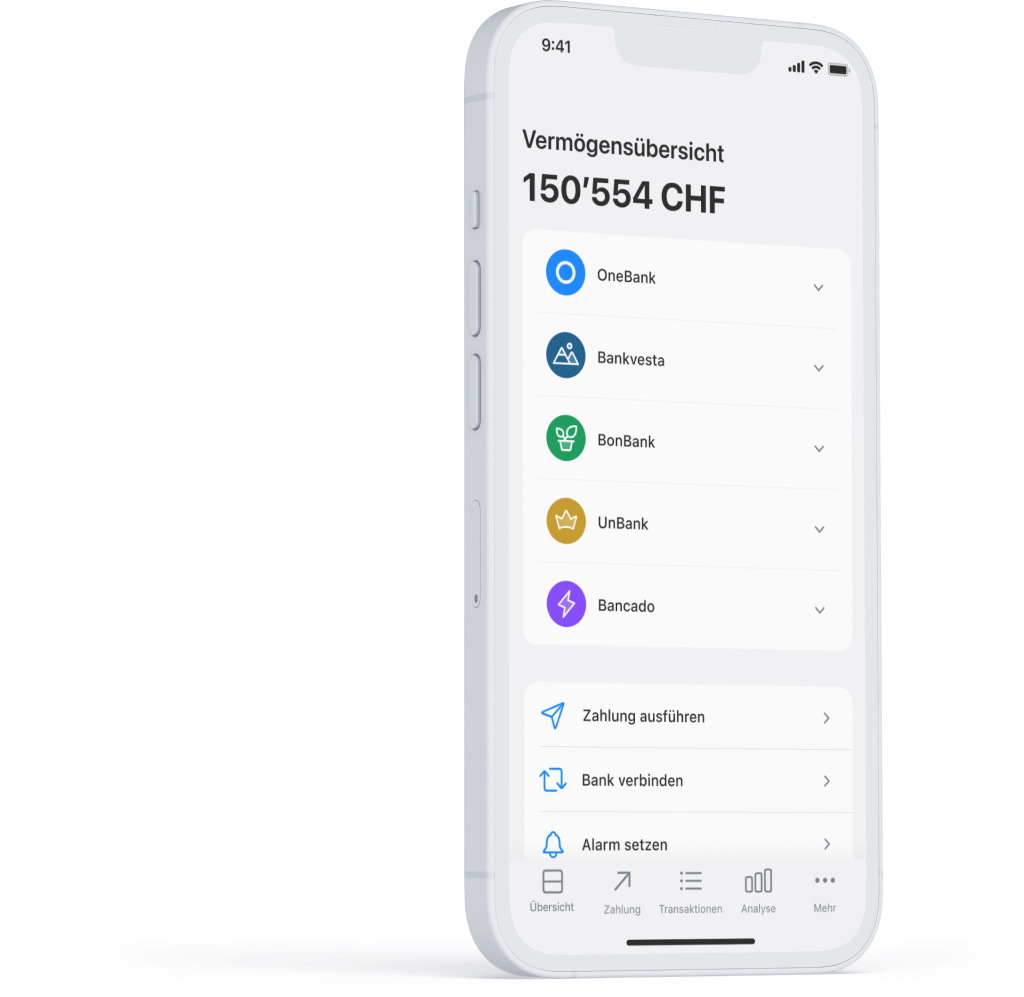

Multibanking for retail customers allows you to manage bank accounts from different institutions in one central location. This is what having a holistic view of your finances looks like.

Multibanking for retail customers allows you to manage bank accounts from different institutions in one central location.

Contact our experts

Multibanking for retail customers

Contovista’s multibanking solution seamlessly integrates with any digital banking system, independent of the core banking system. As a “service user”, Contovista can already offer full multibanking capabilities with platforms such as bLink.

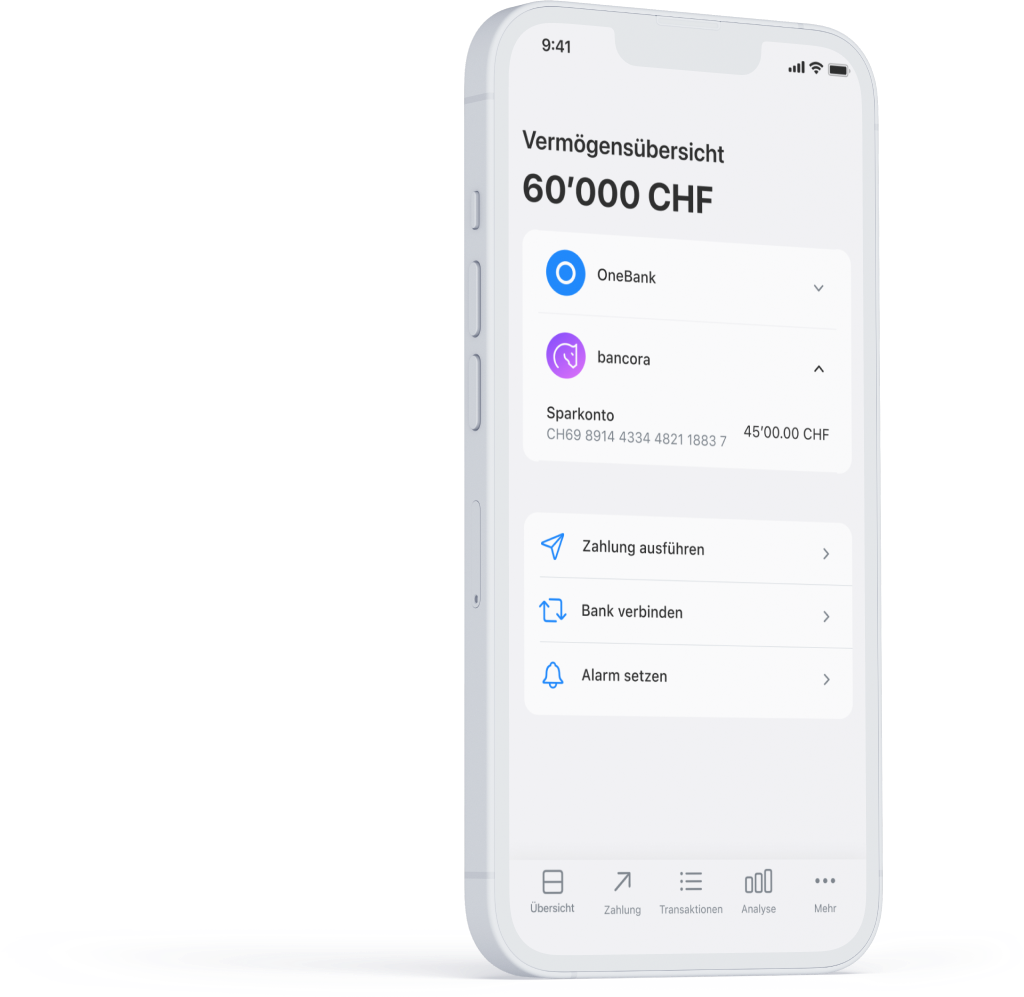

With automated account aggregation in multibanking, your customers can reap the benefits of automated balance reconciliation and a real-time consolidated overview of their finances. They can access all their accounts from different banks in one digital banking environment with a single login. This streamlined approach simplifies the management of multiple accounts, enhances transparency, and offers greater convenience for users.

Full overview thanks to multibanking

Effortless bank integration

Your customers can seamlessly add new banks to their digital banking account with just a few clicks.

Comprehensive financial overview

Get an instant financial overview thanks to automated account aggregation of all linked accounts.

Simplified access with one login

Automatic categorisation of connected accounts, including transaction data enrichment with merchant logos and “pretty names”

Multibanking with Contovista

Set the course for the future today

In spring 2023, the Swiss Bankers Association (SBA) and approximately 20 banks signed a Memorandum of Understanding to facilitate the introduction of the first multibanking services for individual customers by mid-2025. The goal is to enhance interoperability and data exchange among banks, FinTechs, and other financial institutions.

Alongside the core multibanking functions, the Personal Finance Manager (PFM) offers your customers a range of additional benefits. For instance, transactions from external banks are automatically categorised, enriched, and can be analysed across all linked institutions.

This enhancement in the informative value of the analytics provides significant advantages for users. As a bank, it translates into increased engagement and potential as well as targeted & personalised cross- and upselling opportunities.

By leveraging the full suite of PFM functions, your customers can actively enhance their financial situation. With multibanking and PFM, your institution becomes an even more vital interface and the primary financial touchpoint for your customers.

Still got questions?

If you have any further questions regarding Contovista’s multibanking offering for retail and business customers, or if you would like more information about the Memorandum of Understanding, please don’t hesitate to reach out to us.

Get in touch