AI Personal Finance Manager

The AI-powered financial cockpit for digital banking innovation, hyper-personalised insights, and integrated client analytics features.

The AI-powered financial cockpit for digital banking innovation, hyper-personalised insights, and integrated client analytics features.

Contact our experts

Financial assistant for hyper-personalised banking

Contovista’s AI Personal Finance Manager is the intuitive financial cockpit of tomorrow’s hyper-personalised digital banking. Using real-time data analytics and artificial intelligence, we support financial institutions in using transaction data effectively.

With Contovista’s Finance Manager, banks can strengthen their leading role in the market and become pioneers in utilising data to enhance business processes and deepen the digital customer relationship.

The integrated client analytics features combine all relevant tools in a single, efficient system, and thereby create the basis for successful client relationships.

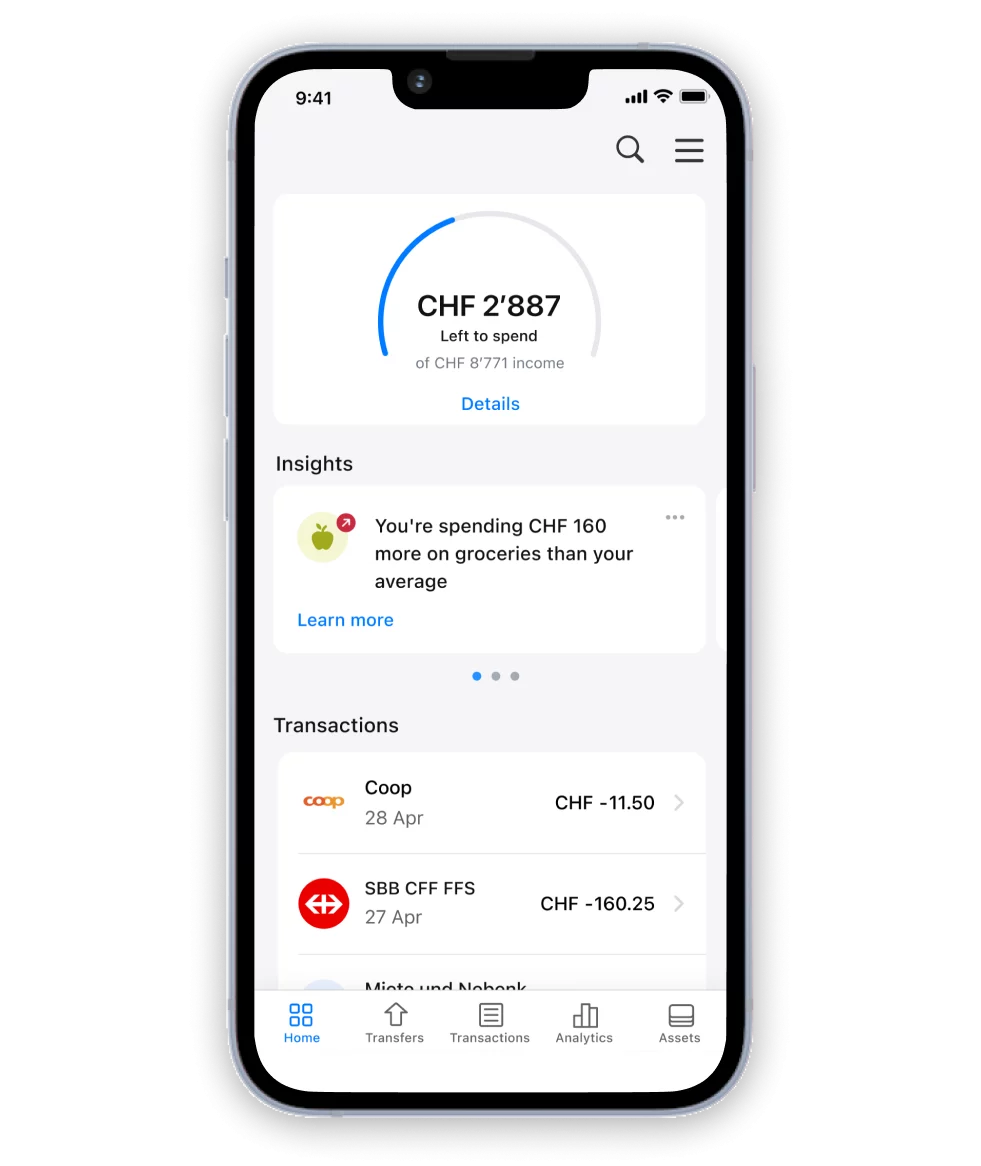

Finance Manager for Digital Banking Users

Contovista’s AI Personal Finance Manager offers a variety of features that help your customers improve their financial situation through intelligent analytics combined with hyper-personalised data and real-time insights.

With data-driven insights into individual financial situations, you improve your customer relationships and boost customer satisfaction and engagement. Through the continuous development of innovative features, financial institutions are equipped for the banking of tomorrow.

Understand

Complex financial data visualised in a clear and transparent way.

Coach

Real-time, customised tips and recommendations for achieving financial goals.

Enable

Personalised insights help to manage finances in a more independent way.

Benefits for Your Customers

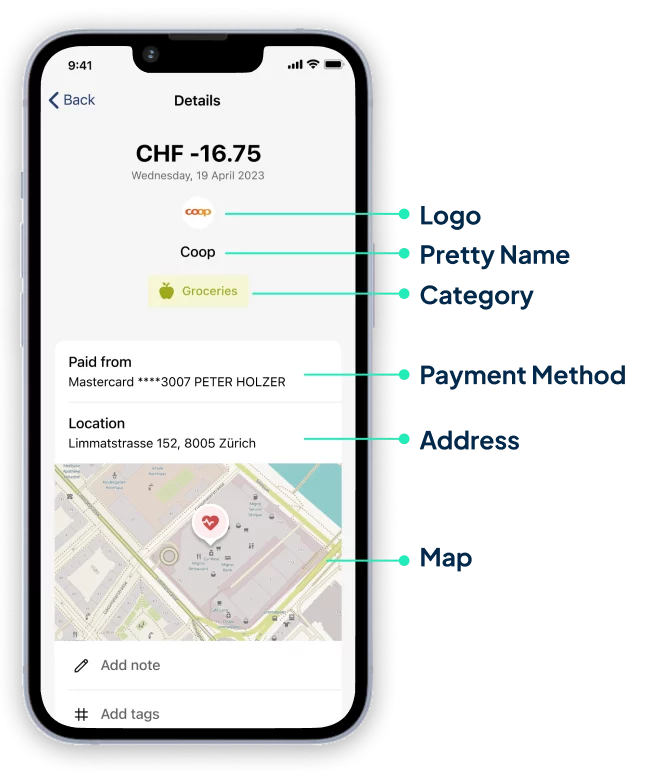

Automated categorisation

Transactions are automatically categorised and visualised with the corresponding logos and pretty names. This provides customers with a clear and structured overview.

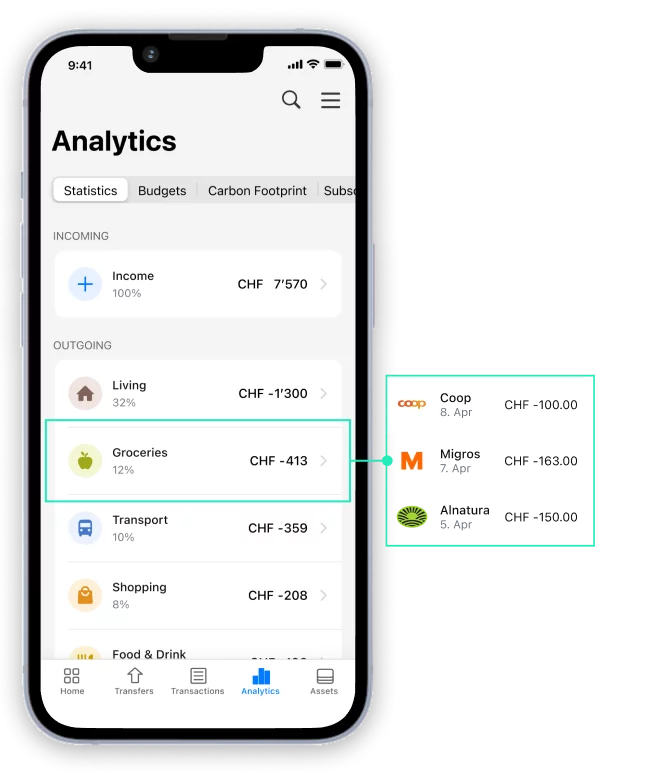

Analytics

The intuitive user interface and automated categorisation make it easier for your customers to better understand their finances. Thanks to the clear presentation, users can gain deeper insights into their spending behaviour.

Hyper-personalised financial insights

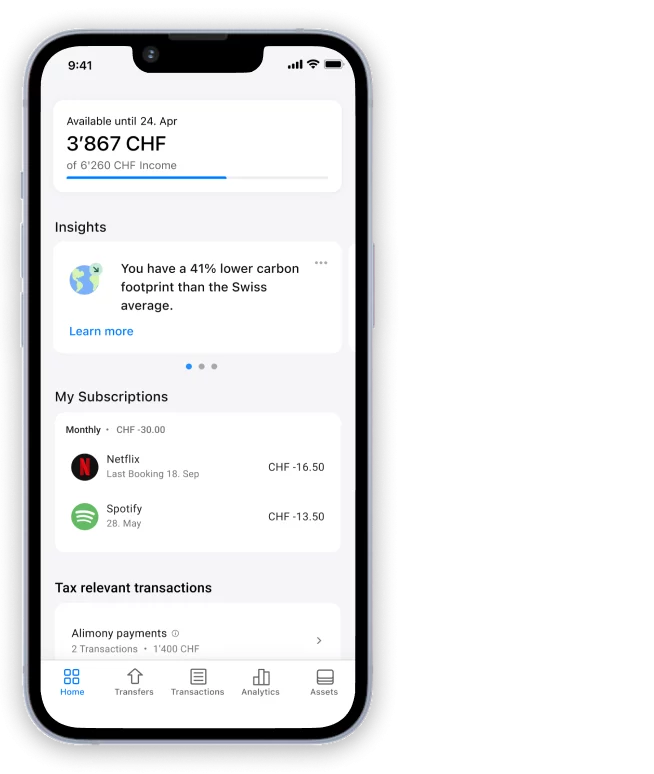

Thanks to hyper-personalised insights, your customers’ financial lives are made even easier thanks to automatic notifications about refunded payments, expected subscription payments, or increased spending in a certain category.

Customer-centric innovation

The AI Finance Manager is constantly being enhanced and updated with new user-centric functions, e.g. users receive personalised tips on tax-relevant transactions, private pension provision (pillar 3a), and other features.

Cross-bank management of finances

Our multibanking solution can be easily integrated into any digital banking solution irrespective of the core banking system. Contovista is already fully multibanking-capable via platforms such as bLink.

Thanks to automatic account aggregation with multibanking, your customers benefit from an automatic balance reconciliation and a consolidated real-time overview of all their finances with just one login, all within a single digital banking environment.

Through the integration of value-added services, the customer experience and convenience for private customers is further optimised and a customer-centric banking ecosystem established. Customers also benefit from intelligent tax deductions that automatically flag deductible transactions as well as hyper-personalised insights across all accounts.

Calculate an individual’s CO₂ footprint

The Carbon Footprint Manager calculates an individual’s carbon footprint based on their transactions and compares personal CO₂ consumption to the Swiss average. It then automatically assigns this to the correct category, providing a clear overview of consumption behaviour and the resulting carbon emissions.

The foundation of this approach is a comprehensive, intelligent analysis of financial transactions, utilising Swiss climate data. By incorporating gamification elements, personalised recommendations are provided to help customers reduce their carbon footprint, making it easy for them to take immediate action.

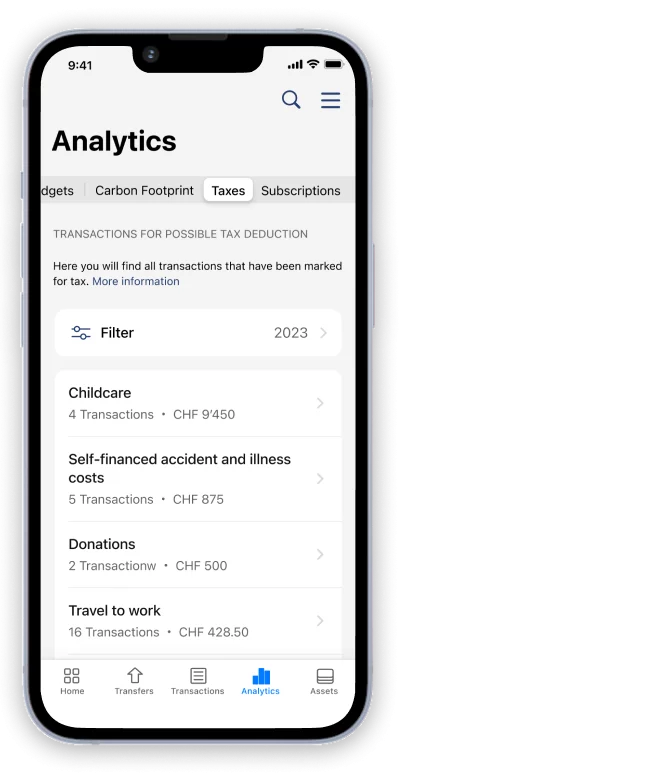

Automatically identify deductible transactions

Thanks to automated notifications, users are informed about tax-deductible transactions directly in their digital banking. What’s more, transactions themselves can be marked as tax-deductible while relevant receipts can be uploaded.

In other words, users have all the transactions for their annual tax return right at their fingertips – resulting in a significantly simplified process with no deductions being overlooked.

Value-added services

A variety of value-added features that help your customers actively improve their financial situation on a daily basis include:

- A dashboard with hyper-personalised insights

- Income and expenditure statistics and analytics

- Display of all subscriptions at a glance

- Automatic marking of tax-deductible transactions

- Customisable savings goals in virtual sub-accounts and flexible budget features

State-of-the-art AI

Our algorithms provide precise customer analytics and enable banks to create personalised offers.

All-in-one solution

Simplify your processes with a single platform for personal finance management and AI-empowered customer analytics.

Seamless integration

Flexible architecture for fast, hassle-free integration into existing IT landscapes – regardless of the core banking system.

AI Financial Cockpit with Client Analytics

The Finance Manager with the integrated Contovista Enrichment Engine is the ideal solution for banks that want to utilise their transaction data for a variety of purposes.

From automating internal processes and enhancing risk modelling to developing innovative products, we help financial institutions drive efficiency, reduce costs, and unleash new business opportunities. The all-in-one solution is independent of the core banking system and enables financial institutions to leverage the full potential of their transaction data.

Not all your questions answered yet? Talk to us.

Do you have questions about our finance management and analytics solutions? Simply get in touch! We’ll be happy to advise you.

Contact us