Carbon Footprint Manager

Calculates the carbon footprint of users and provides them with information on their emissions in the most important transaction categories along with relevant tips and insights.

Calculates the carbon footprint of users and provides them with information on their emissions in the most important transaction categories along with relevant tips and insights.

Contact our experts

Transaction-based CO₂ calculations

The Carbon Footprint Manager is an add-on module for the AI Personal Finance Manager (PFM). It analyses all transaction data and calculates the corresponding carbon footprint (key figure: kilograms of CO₂ emissions in relation to the transaction amount in CHF). It calculates an individual’s carbon footprint based on transactions and sets their personal CO₂ consumption in relation to the Swiss average.

High-quality Swiss climate data

Understanding and improving CO₂ consumption

We use more than 90 data sources and methods to calculate an individual’s CO₂ footprint. CO₂ consumption can be broken down by month or year and is automatically assigned to one of the following categories: Food, Home, Travel & Transport, Shopping, and Health & Leisure.

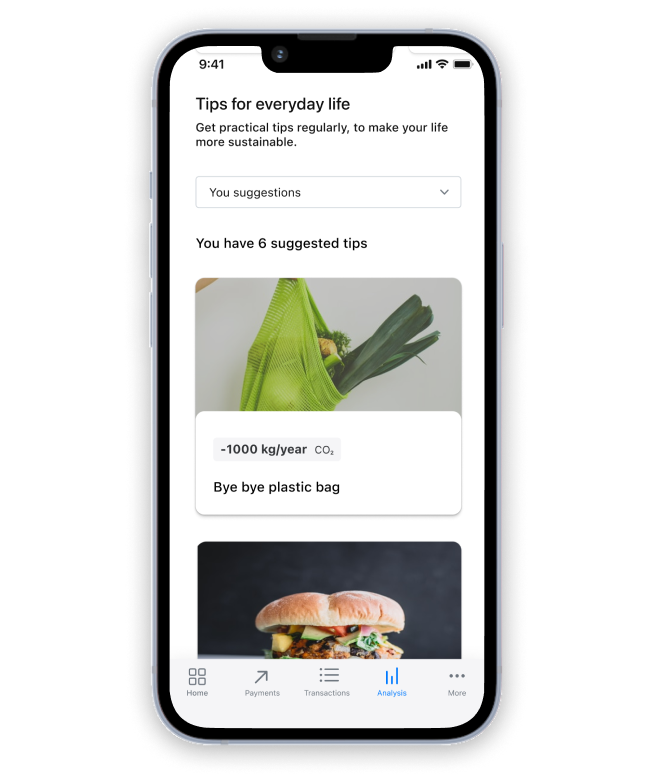

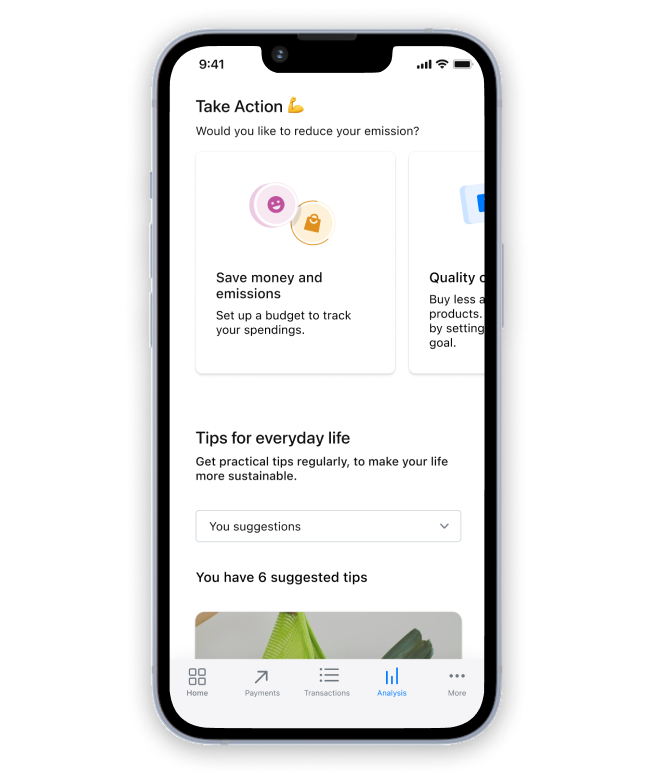

Tips & Gamification

With tips and gamification elements that are constantly being expanded, concrete recommendations for reducing your footprint are suggested that can be saved and directly implemented by your customers.

Increasing engagement

Thanks to the Carbon Footprint Manager, you increase engagement in digital banking, address sustainable target groups and stand out from other banks.

Understand

Personal CO₂ footprint based on transactions compared to the Swiss average.

Coach

Personalised tips with gamification elements to lowering CO₂ emissions.

Enable

Achieve sustainability goals with sustainable budgets and cross-sell to the bank’s sustainable products.

In everyday practice

Consumers want to act, shop, and live in a more sustainable manner. One particularly effective approach is for banks to support their customers in taking action against climate change themselves.

With the CO₂ Footprint Manager, you pick up your customers exactly where they are, namely in their private account that reflects their own consumption.

As a solid foundation

The CO₂ calculations are based on Swiss climate data. The calculated CO₂ results serve as a solid foundation for an effective assessment of one’s own CO₂ consumption.

The Swiss database allows users to see how their carbon footprint compares to the Swiss average. Positive feedback helps with the self-assessment and encourages users to reduce their personal emissions in the long term.

For additional products

The Carbon Footprint Manager enables customers to implement their sustainability goals in a concrete way and allows you to target customer interests with sustainable product suggestions, thus creating new cross-selling potential.

Analyse the carbon footprint of third-party banks

Third-party accounts at third-party banks can also be integrated, provided that the multibanking option is used by the respective bank.

The transactions are automatically divided into the carbon footprint categories Food, Home, Travel & Transport, Shopping, and Health & Leisure and are also aggregated via the third-party accounts.

Any questions?

Do you have any further questions about Contovista’s CO₂ footprint manager? Just drop us a line.

We will be happy to help with any questions you may have!