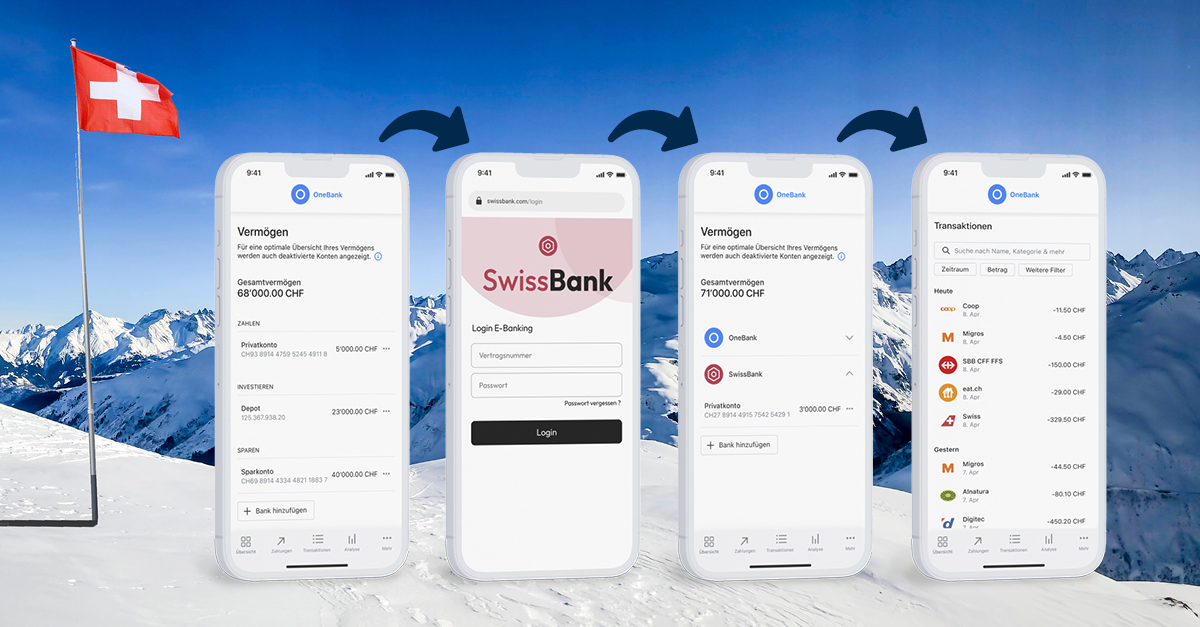

As a Swiss pioneer in multibanking for SME, we’ve been implementing advanced multibanking solutions for banks for several years – enabling efficient financial management across multiple accounts. Drawing on this extensive experience, we now deliver highly innovative solutions for retail banking as well: from standalone multibanking for individuals to the multibanking-enabled AI Personal Finance Manager with a wide range of value-added services.

The roadmap for multibanking in Switzerland is already well underway. The testing and implementation phases have been successfully completed. Our partner banks conducted “friends and family” testing in production environments months ago, and the nationwide rollout for retail customers began in September.

We expect additional financial institutions to launch their own multibanking offerings in the coming weeks. From there, the powerful platform effect of Open Banking will take hold – a banking revolution that benefits everyone: financial institutions, third-party providers, and, most importantly, customers themselves.