Thanks to the long-standing Open Banking partnership with Contovista’s data experts, Raiffeisen benefits from the innovative strength of a dynamic FinTech and can regularly offer its customers new updates and added value.

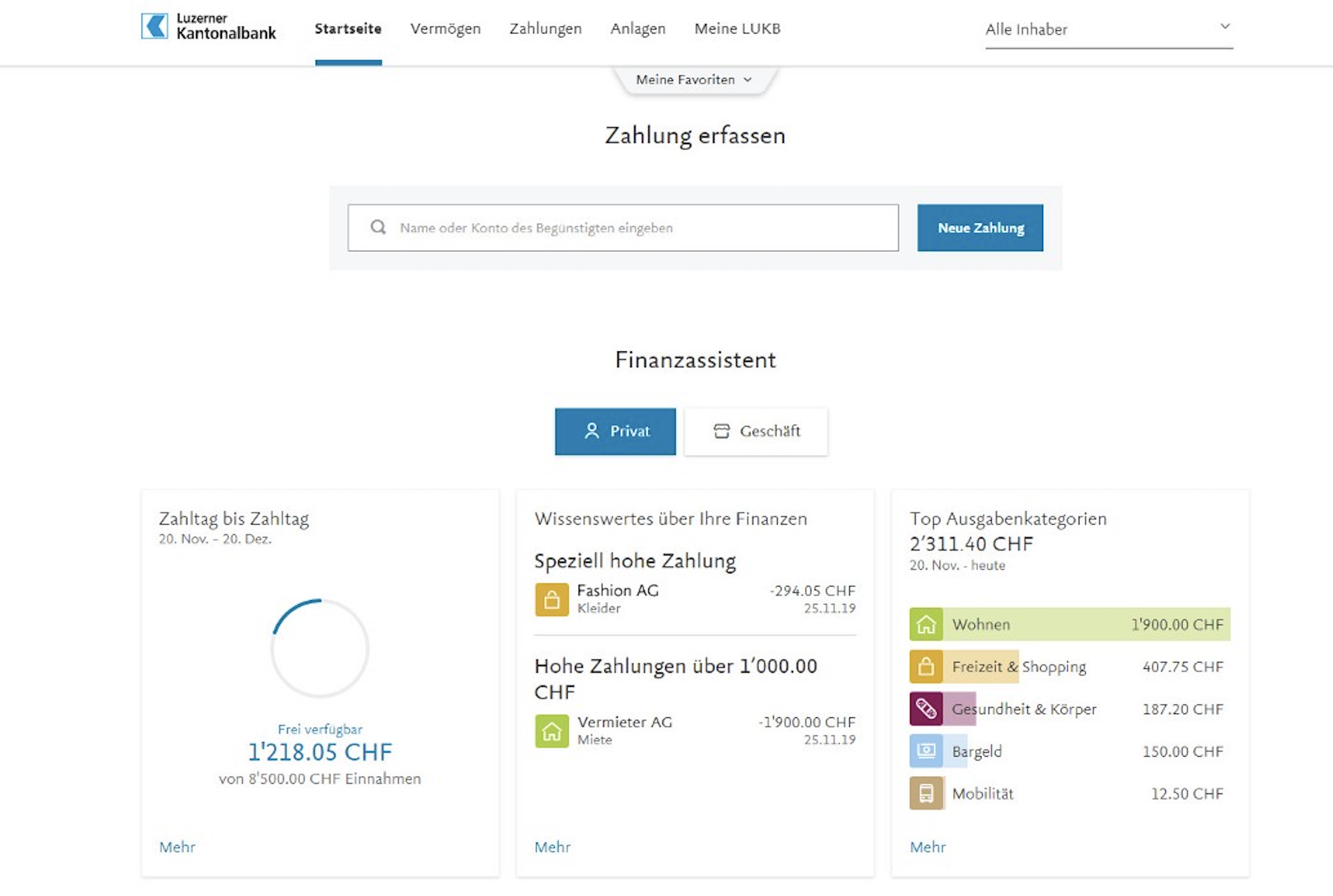

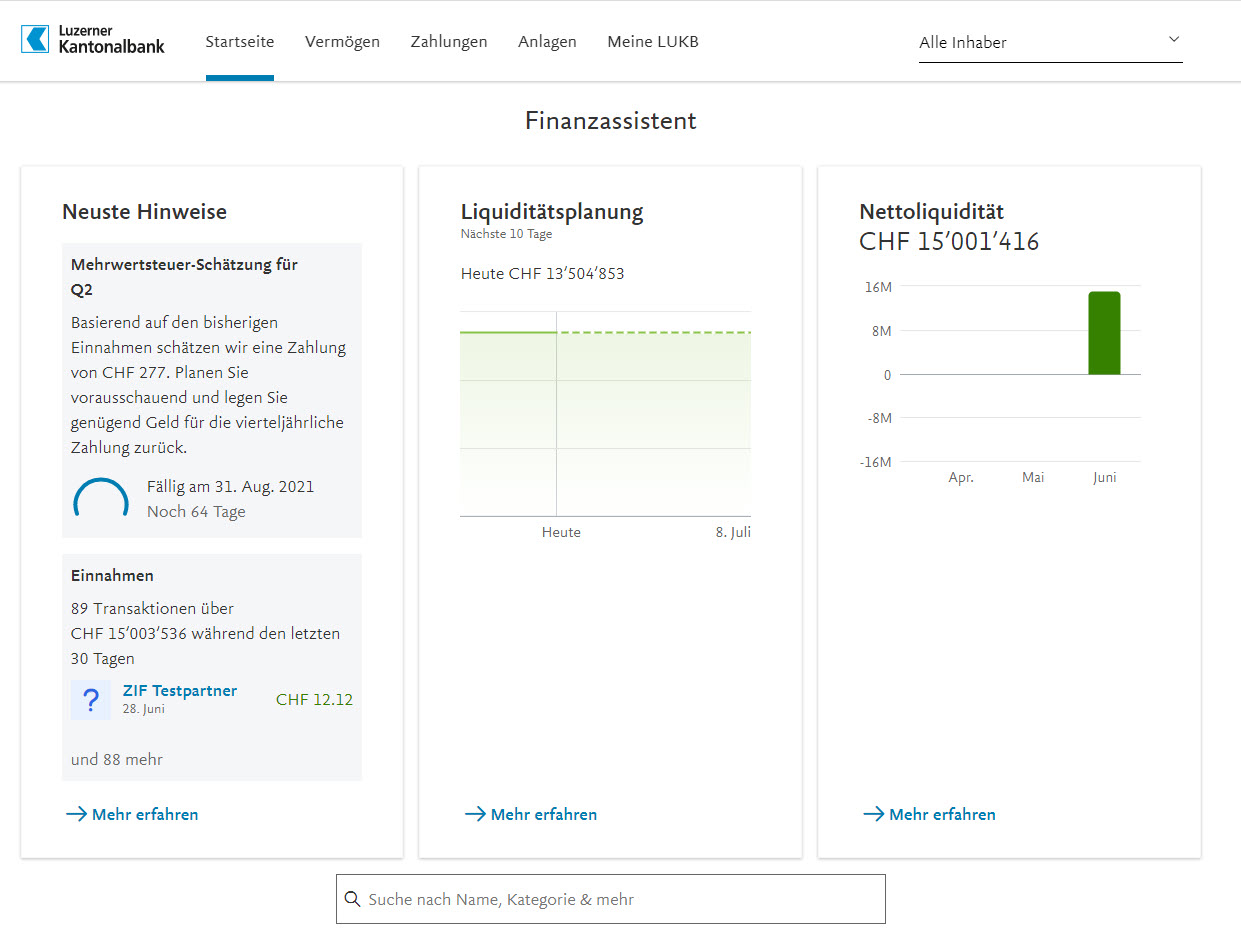

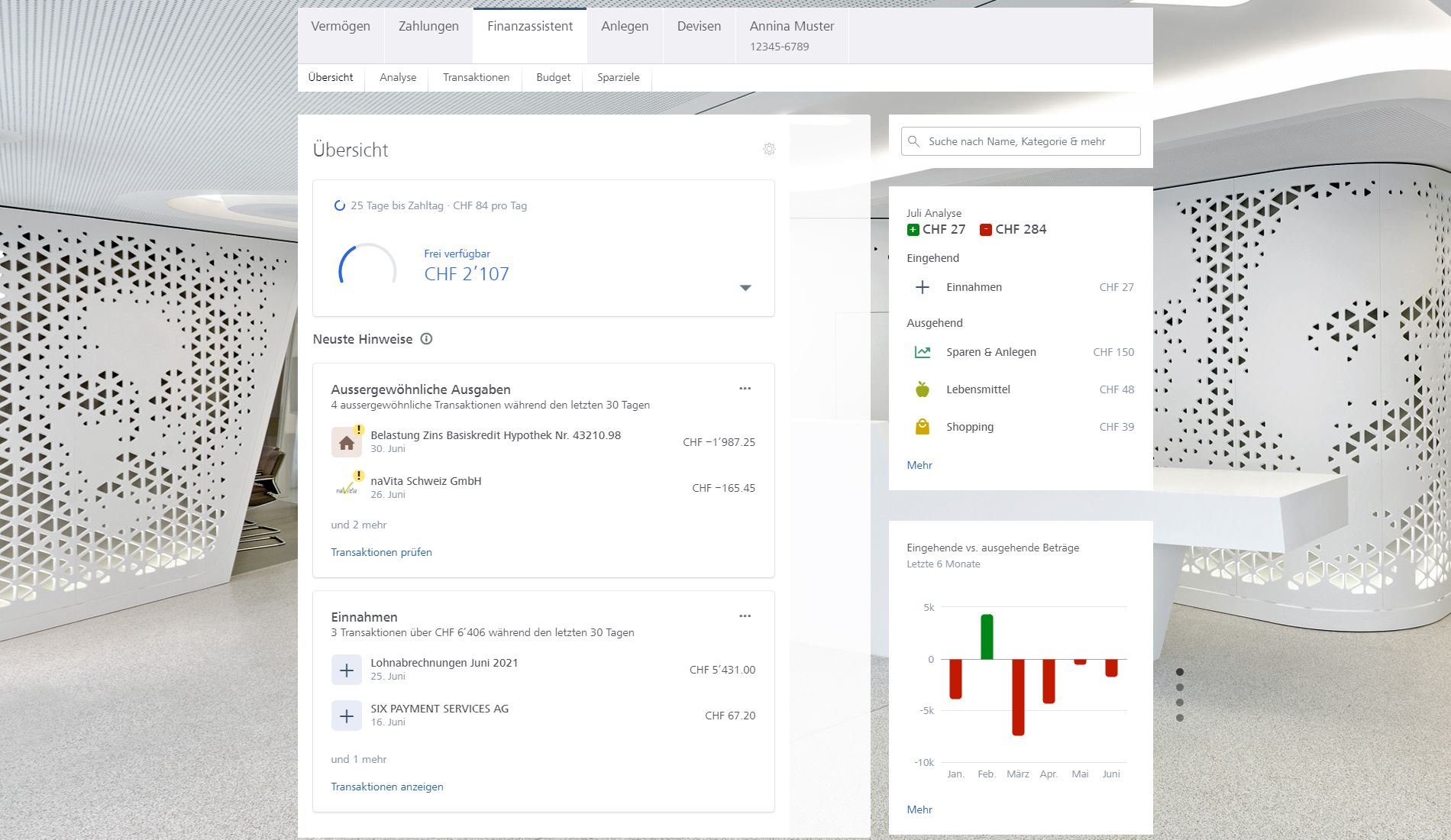

These benefits are clearly illustrated by the example of the financial assistant, which undergoes continuous development by Contovista. As part of the regular updates, the approximately 1.6 million e-banking users receive the very latest functions to ensure an innovative banking experience. The financial assistant is fully integrated into Raiffeisenbank’s e-banking and impresses with its clear design and the many, customer-friendly details that give users optimal control over their finances.

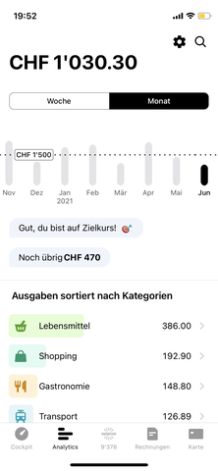

Based on intelligent data enrichment and analytics, the AI-driven solution provides real-time insights and proactively highlights key events. Services such as semantic transaction search, merchant logos for better orientation, and advanced budget planning with daily alerts complement the existing customer offering. There’s also a monthly “left to spend” calculation, helping to better manage spending based on monthly incoming cash flow.

The result? Bank customers have better control over their finances, banks boost customer loyalty and can respond to customer needs in an even more personalised way in the future with highly relevant offers and recommendations.

… Learn more about how to stay at the top of the game in our free whitepaper Data-driven Banking: