The Banking of the Future

Open Finance, Open Banking and Multibanking

Open Finance, Open Banking and Multibanking

Open Finance, Open Banking and Multibanking

Digital trends and innovative approaches continue to alter the way people manage their finances and banks conduct their business. New terms like Open Finance and related applications such as multibanking are two particularly striking examples of this.

As Swiss experts in data-driven banking, we at Contovista are at the forefront of these developments – and are pleased to share our insights with you in this overview of Open Finance and multibanking in Switzerland.

1.What Is Open Finance?

Open Finance refers to the opening of interfaces that allows customers to use innovative digital services from third-party providers in their everyday financial lives using their own data. But what’s actually behind it?

What’s behind Open Finance?

An essential driver of these new business models is the data economy, based on the exponentially growing volume and sharing of digital information. Under the motto “Open Finance”, ambitious financial institutions are now opening their data interfaces to third-party providers and offering data-driven services themselves. As a result, customers reap the benefits of a wide range of innovative digital services.

Open Finance: Technologically Advanced, Easy to Implement

Open Finance represents a particularly promising digital field of the future because the financial data from banks is incredibly rich and valuable. Account data provides insights into the consumption, behaviour, and preferences of users. Integration of data sources into digital solutions usually takes place via API interfaces (application programming interface).

Technical effort is minimised as a result, while services can be obtained as-a-service from third-party providers (“API economy”). The Open Finance trend is currently enjoying considerable success on the international stage. In Europe (including Great Britain), the number of regulated third-party providers increased from 133 in Q1 2019 to 556 in Q2 2023. According to prognoses, the worldwide market for Open Banking will increase by 26.8 percent(CAGR) on average each year until 2030.

Open to Innovation: New Options for Customers

The platform effect means that customers can use additional third-party services through Open Banking and Finance. Providers of these services include developers of digital tools, FinTechs, and startups.

Multibanking solutions have already established themselves in the business customer segment. Particularly attractive third-party services for this group of users are also, for example, efficient and convenient accounting tools, which directly access the date of the business account. This is especially interesting for small and medium-sized enterprises.

Retail users benefit from multibanking as well, and thus gain a holistic overview of their finances. Furthermore, new functions are emerging, such as budgeting and analysis options, for example to calculate carbon footprints of individual consumers, intelligent tax deductions, or subscription overviews. Such functions are made available by your main bank or third-party providers via digital banking for instance. Through multibanking, these features can be used much more effectively (see section 2 below).

With such value-added services, customers gain greater functionality from their accounts. A requirement for this is often the categorisation of transaction data. This information can then be used by other applications.

Open Finance: Added Value for Everyone

The benefit of Open Finance is crystal clear for customers, coming in the form of new services if they want them. In turn, banks gain by positioning themselves as customer-centric partners for their customers. This allows them to offer value-added solutions that drive customer loyalty and open up new business areas (see section 3 below).

For established banks in particular, such offerings are vital for standing up to their digital competitors. But the general public also benefits. As McKinsey points out, using open financial data could increase a country’s economic output by 1 to 5 percent by 2030.

2. The Rise of Multibanking

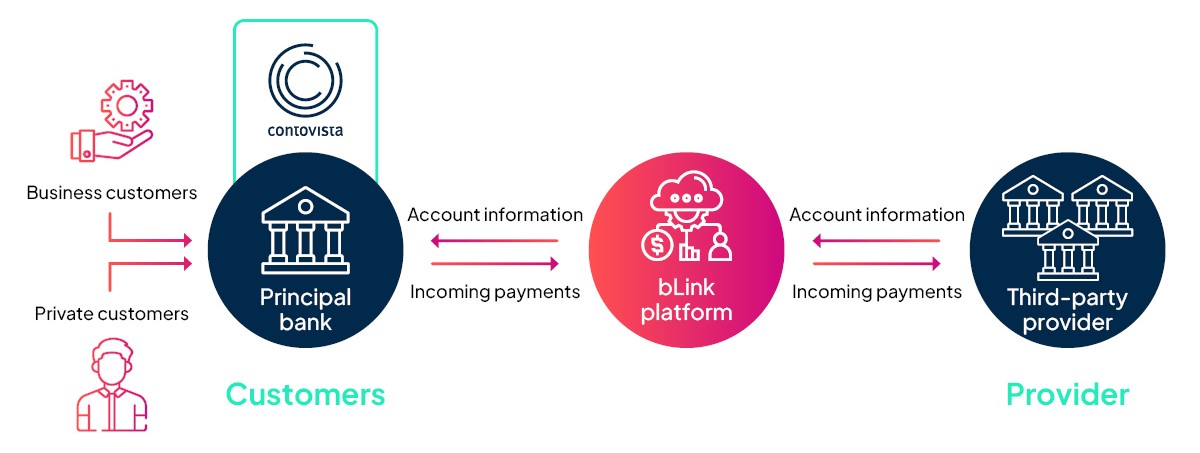

Multibanking is a prime example of Open Banking, where users can conveniently access other bank accounts via their main bank.

Open Banking and Finance opens up a plethora of new digital possibilities. Among these, multibanking stands out as particularly appealing. The term “multibanking” refers to access to account data and functions at other banks via a central digital banking system. In other words, multibanking provides access to external account information and account functions such as payment initiation.

Although multibanking has existed in Switzerland for some time, until recently it has been for business customers only. Now, however, multibanking is gaining momentum in the retail customer segment. Corresponding standards and consortia are already available, such as the API platform bLink.

Multibanking: Open to Private Customers

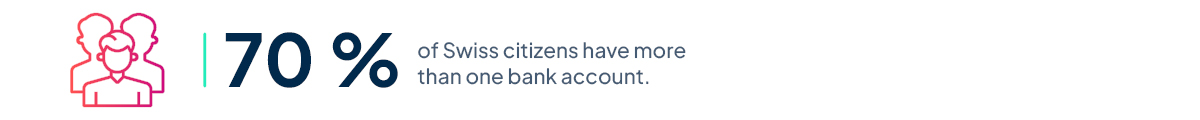

So, how do customers view the opportunities afforded by multibanking? According to surveys, they are very open to it – but it must not cost anything. According to the survey, around 70 percent of Swiss citizens have more than one bank account, with an average of 2.2 banking relationships. Consequently, a multibanking service with the option of centralised account management would be highly relevant to them.

For retail customers, multibanking offers many advantages and, above all, services that were simply not available before. In their normal account overview, customers now have an overview of all their financial information. Depending on the technical design, they can also obtain additional information, analyses, and features.

Strategic guidelines for the implementation

Financial institutions should factor in a range of fundamental guidelines into their multibanking strategy, which go beyond the mentioned aspects and features. To begin with, it is important to focus on a mobile-first approach from the outset: after all, app-based banking is a must for many of today’s users since smartphones are often the preferred platform. Here, it must be ensured that the multibanking functions fit seamlessly into the provider’s digital banking. This increases the customer’s readiness to use them – the same is true for other innovative value-added services provided by the bank that increase incentives for high user engagement. Generally speaking, the user experience of the interface is one of the most important drivers for the end customers’ decision for or against certain offers.

3. The Benefits of Open Finance and Multibanking for Swiss Financial Institutions

For Swiss banks, Open Banking and Finance brings a number of key advantages, especially if they position themselves as first movers.

From a bank’s perspective, Open Banking offerings such as multibanking also provide many advantages. They are useful for customers – and what benefits customers, of course, also benefits the bank. The satisfaction of bank customers increases, while the data-driven 360° overview of customers facilitates customer-centric value-added services. A bank with a multibanking offering is an ideal main bank, acting as a one-stop-shop for all financial matters. With multibanking, banks can strengthen their customer interface while boosting customer loyalty.

All this makes multibanking the perfect entry point into Open Banking and Finance, as it paves the way to further forward-looking options that can bolster sales and market position: tailored offers, cross-selling and upselling, as well as other new revenue streams. Banks can also benefit from earning fees and commissions paid by third-party providers.

With multibanking, banks are able to accelerate their digital transformation – as well as digitalise, automate, and optimise processes in the long term. Established banks in particular can secure their future viability by leveraging their core strengths:

- These banks typically enjoy a high level of trust as an institution among their customers.

- At the same time, as a main bank, they have extensive data and information about their customers, which they can use to make better, more personalised offers.

Trust is a crucial factor influencing the general willingness of account holders to engage in Open Banking, i.e. to use transaction data.

Trust, Reciprocity, and Security

The primary prerequisite for Open Banking and Finance is the opening of interface(s) to third parties. At this point, some institutions might still hesitate out of caution. However, this opening should definitely be viewed as an opportunity: after all, the partner companies, third parties, and even competitors with whom the data is shared are also opening their interfaces. Reciprocity prevails – and all participants can reap the benefits. If banks proactively introduce Open Finance offerings to the market, they will certainly be several steps ahead of non-participating institutions – representing an attractive opportunity that must now be seized.

Building on this foundation, the platform effect enables a vibrant ecosystem of innovation that constantly generates new solutions, benefiting all participants. Security, data sovereignty of the participating banks as well as the customers, and consistent access rules are centrally ensured, creating a reliable and enduring basis of trust.

The Green Light Has Been Given for Open Finance in Switzerland

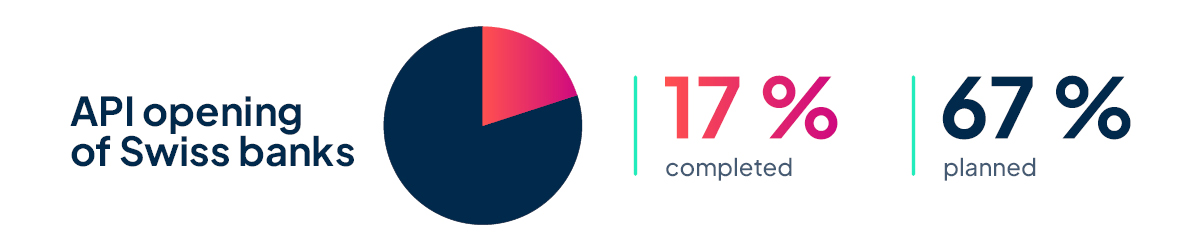

Established banks cannot ignore Open Finance if they want to maintain their competitive position. However, there is still a lot to do in Switzerland in terms of implementation: in a study from 2023, 27% of banks stated to have completed an API opening and a further 43% plans to do so. Smaller banks still hesitate: as per the study, financial institutions with a balance sheet of under CHF 1 billion do not yet have any API openings at all and 67% do not even plan on implementing them.

In part, Open Finance is still regarded as a purely IT issue, yet it holds immense strategic significance. According to Accenture, Open Banking could hold a global revenue potential of up to $416 billion for the financial industry. In other words, everyone really does benefit, customers and banks alike.

The government has long seen it this way, too. Unlike in the EU (PSD2), there is no regulation in force in Switzerland (yet) that makes Open Finance mandatory. In the EU, the Payment Services Directive (PSD2) set the regulatory foundation for Open Banking. With the planned new regulations around the revised directive PSD3, the EU’s approach will be expanded even further towards Open Finance: requirements will be specified, and other sectors – such as insurance – will be incorporated.

But even in Switzerland there is movement. The Federal Council requested Swiss banks to come up with initiatives in this area until June 2024. Otherwise, it is likely that further requirements regarding this will follow.

In Switzerland, the focus is therefore on industry self-initiative rather than regulation, which opens up important leeway, especially for first movers. Banks should now live up to this claim – not only in terms of regulation, but also out of strategic self-interest.

A Question of Ambition: Options for Implementing the Memorandum of Understanding

The Swiss financial industry has responded to the call of the Open Finance initiative by recognising multibanking as a suitable first major contribution from the industry. To this end, a Memorandum of Understanding has been signed by over 20 Swiss banks, including UBS, Valiant, Luzerner Kantonalbank, Hypothekarbank Lenzburg, Post Finance, and Migros Bank.

Various implementation options are described here, which interested institutions can use as guidance, according to their level of ambition and individual circumstances. Depending on the time of participation, a distinction is made between first movers (Q3 2024) and fast followers (Q2 2025). Late followers (2026 and beyond) can also be added as a third option, as outlined in by Synpulse.

bLink: the Swiss platform for Open Finance

The pioneering platform bLink of the SIX Group that launched in 2020 very clearly represents an important step towards Open Finance and multibanking in Switzerland. Banks as well as third-party providers and other finance companies may participate on the platform, if they fulfil the necessary requirements. Central standards – such as consistent API, approval tests, and transparent consent management – build a solid, trustworthy foundation. Participating companies can act as service users as well as service providers, for example with services in the context of account information or account functions.

The bLink platform is developed further on an ongoing basis – and it continues to grow. New features are planned for the near future. Additional use cases in the areas of wealth management, tax applications, or connections to offline service providers will be added. By scaling the existing AIS interface, participants gain high-quality access to private customer data.

4. Open Banking and Multibanking Solutions from Contovista

Contovista’s multibanking solution offers a fast, seamless entry into the world of Open Banking and Open Finance. Multibanking in conjunction with the PFM financial cockpit opens up additional forward-looking features.

Entering the digital world of Open Finance brings with it a whole range of key benefits. What’s more, multibanking is an ideal use case for the implementation of hands-on Open Banking. The added value for customers is clear, as they can also manage their accounts from other banks in the institution’s digital banking system – having this overview makes managing their finances better and easier.

In turn, banks can use the offering to expand their special position as a main bank that supports customers as a reliable partner in their everyday lives. Multibanking enables banks to create more touchpoints and retain customers by offering them additional services and products. Such a customer-centric approach is a major advantage when competing with mobile challenger banks.

Eliane Albisser, Head of Product at Contovista: Multibanking for Retail Banks (Select English subtitel in player).

The Entry into Multibanking: Effortless Implementation with Contovista

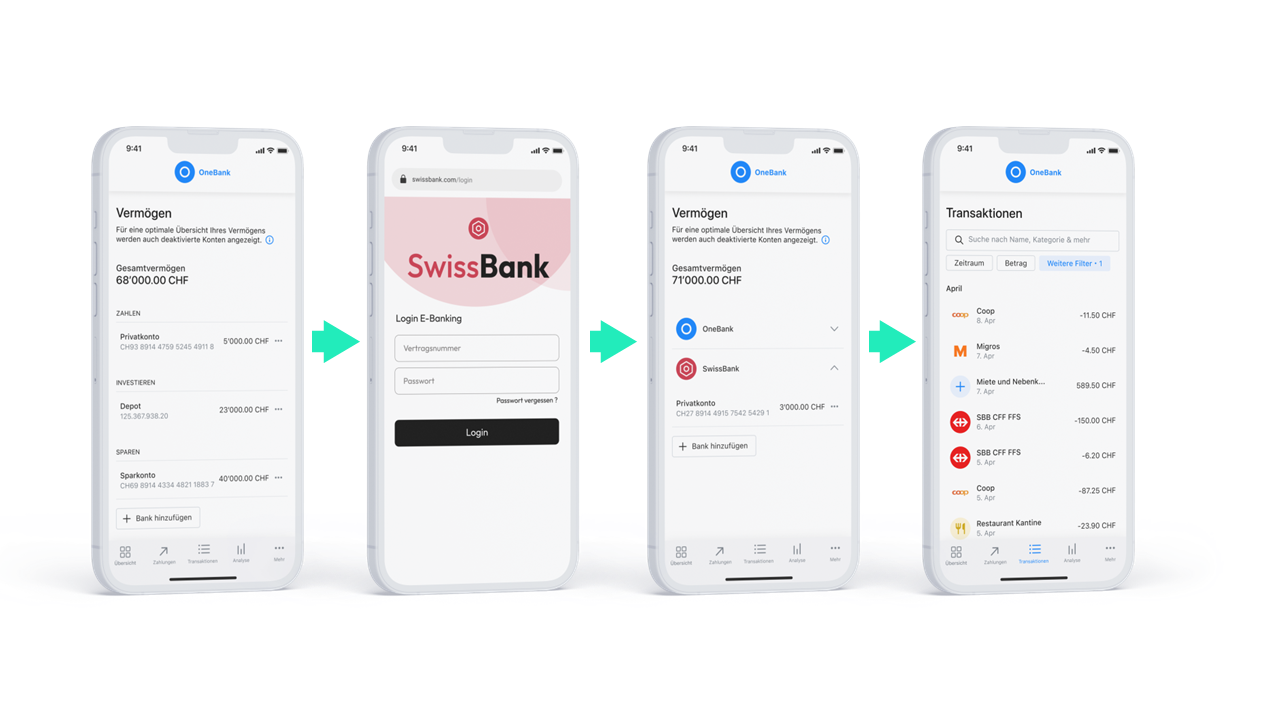

To meet these requirements, Contovista already offers a multibanking solution for financial institutions that is easy and quick to implement. This way, banks can seamlessly offer Open Banking to their customers within their existing system.

Onboarding is smooth and convenient for customers – requiring just a few clicks. They will have access to third-party account information in the account overview, providing a consolidated view of all connected accounts. Among other features, the solution offers an assets page and a breakdown of transactions. Data refinement based on machine learning enables the specification of “pretty names” and merchant logos, which significantly enhance user convenience.

If financial institutions aim to position themselves as digital first movers, this Open Banking enabler in the retail banking sector provides them with an effective lever. The powerful API solution developed by Contovista for multibanking follows the standards of bLink. This forward-looking platform for Open Finance in Switzerland is provided and operated by SIX.

Bild: Multibanking für Retail – Mit nur wenigen Klicks Drittbank-Verbindung hinzufügen.

The Data-Driven Potential of Multibanking: Open Banking in Practice

The data-driven opportunities of Open Banking and Open Finance are only partially exploited by a pure multibanking approach. Additional potential can be realised when it comes to the intelligent use of data. For this purpose, Contovista has developed the Personal Finance Manager (PFM) – an intelligent financial cockpit for retail customers that offers institutions even more advantages. It also gives customers access to a digital financial assistant.

Value-added services by Contovista

The multibanking solution with PFM opens up a diverse range of comprehensive functions based on current transaction data. The transactions of all connected accounts can be filtered and searched. Customers can create and manage budgets. Advanced analyses and personalised, actionable insights are provided. When combined with multibanking, the benefits of these PFM options are compounded as they are now available across all accounts.

Further features include a subscription overview, which helps identify regular payment items, such as media subscriptions. Savings targets, product recommendations, as well as an optional carbon footprint manager complete the range of services. Moreover, PFM offers an intelligent tax deduction function: tax-relevant outgoing and incoming payments will be automatically categorised to help customers with tax reconciliation. This approach is in line with Contovista’s motto: Understand. Coach. Enable. Multibanking is all about ensuring customers reap the benefits. Understand. Coach. Enable. Multibanking is all about ensuring customers reap the benefits.

5. Open Finance and the Future of Banking

In the future, banks will be able to tap into new revenue streams and business models thanks to Open FInance and Finance – extending into other areas of the financial industry, such as insurance companies and pension funds.

Multibanking will be the first comprehensive use case for Open Banking in Switzerland. And that is just the beginning: Open Finance will open up many more financial areas. Insurance, pensions, and investments will also be managed via digital platforms in the future, which will also generate copious amounts of data. Providers such as insurers, pension funds, and brokers etc. are opening up their interfaces, making new offerings possible. The prerequisite for this is universal interoperability.

The EU’s planned Financial Data Access (FiDA) Regulation indicates where Switzerland could be headed in this context – whether the development will be initiated by the market itself or motivated by the regulations remains to be seen. According to present drafts, the FiDa Regulation will also incorporate further areas into the ecosystem, such as insurance, crypto service providers, alternative investment fund managers, rating agencies, and more.

The Financial Revolution Continues

The ongoing expansion of Open Finance use cases will boost competition and innovation, with entirely new services beginning to emerge. These include real-time services, for example, when applying for a loan, personalised offers (vouchers, trips, bonus programmes), and new types of financial products. Among other things, the main bank will then profit by receiving commissions.

Image: Different roles to which financial institutions can tailor their business models in the future.

Many new functions and services of Open Finance are already easily actionable today and are expected to gain more acceptance and become prevalent. For banks and business clients they increase sales, improve the market position, and lower costs.

Image: Unlimited use cases thanks to multibanking and open finance.

Customers enjoy the convenience and exploring new options, some of which are for example:

- Automatic tax features: Besides assets, it will also be possible to automatically import tax deductions into the tax platform in the future. Users will only have to check their preliminary tax declaration and are then able to submit it with a single click.

- Improved dunning and repayment notification processes: Should customers be in arrears with payments, third-party providers can simplify the settlement of payments with the help of a QR code, for example, that already contains all the required payment information. Tools for managing notifications about outstanding payments support customers in finding the optimal payment dates or scheduling instalment plans for repayments or mortgage payments. In the future, apps will automatically carry out the respective payments too.

- Real-time loan assessments: Customers will soon be able to determine if a loan, for example for their dream property, is financially possible for them. The assessment takes place in real-time and is based on real estate data as well as their income, pension scheme, and asset situation.

- Easier loan applications: Having digital insight into customer accounts allows providers to assess loan applications more efficiently. There is no more need for paperwork and customers achieve their goals much faster.

It is especially fintech companies who further contribute to the progress of Open Finance – also in Switzerland. They provide API-based services that end customers can conveniently use via app, including retail offers such as investment apps to centrally manage assets, investments, and savings plans. Other solutions target commercial users, for example wealth management tools for placing orders, smart accounting solutions using real-time data based on AI, or tools for convenient and efficient property management.

Besides the main bank, there are other financial service providers or tech companies entering the ecosystem of Open Finance fintechs. However, banks must position themselves in time. Financial institutions can align their future business models with the various existing roles:

- Universal bank

- Banking-as-a-Service (BaaS)/supplier bank

- Aggregator/retail bank

- Orchestrator

Depending on the individual business models, different perspectives on the innovations in Open Finance arise. However, they all share a demand for strategic and technological advancement in order to make use of trends, such as the spread of everyday AI solutions and the data they generate. A key success factor is to take on a long-term perspective on the topic of Open Finance and underpin it by continuously looking ahead and monitoring trends.

Furthermore, creating a resilient, up-to-date data infrastructure and user experience must be prioritised as central areas of innovation. A foundation of ethically based data governance and transparent interactions within the ecosystem builds trust – which is the essential requirement for the success of Open Finance.

Last but not least, the topic of collaboration plays another important role. Even if many possibilities are still up in the air at the moment, established banks must proactively shape, expand, and strengthen their very own role in this new world today. It is therefore crucial to develop an appropriate strategy as early as possible. The technical implementation of strategies is a critical point since not all of the required steps can be performed by in-house experts of the financial institutions. Collaborating with a technology partner such as Contovista can thus simplify and streamline these processes in a valuable manner.

Contovista as an Innovation Partner

Contovista’s Open Banking solutions are ready to go and can be integrated into existing environments in the shortest possible time with minimal effort via an API. Thus, we facilitate a short time-to-market for banks, with typical projects taking about three to four months.

With the multibanking option we rely on extensive practical experience as a proven technology provider. We are a pioneer in this area, as we have been marketing multibanking capabilities in the business customer segment since 2018. For example, we have already implemented business multibanking in a partnership with Valiant.

The multibanking solution can also be extended by diverse, innovative value-added services. Users and banks benefit from continuous optimisation. We are constantly refining our solutions and will gradually roll out further features. We place particular importance on an excellent user experience, since that is ultimately the key to being accepted by users and to differentiate our offers from those of the competition.

Image: Open finance and multibanking are changing the financial sector.

Open Finance and multibanking are changing the financial industry – and with Contovista, banking institutions are at the forefront of this transformation. When they make the most of these trends, they:

- Meet their sales targets

- Improve processes

- Enhance quality

And above all, they support their customers in finally taking control of their finances themselves.