Community Meeting 2024

AI in banking and open finance

AI in banking and open finance

AI in banking and open finance: The Contovista Community Meeting 2024

This year’s Contovista Community Meeting took place on 26th November at the Kraftwerk-Impact Hub in Zurich. At this exciting event, we met with customers and partners to discuss insights into current trends, future topics, and new solutions for AI in banking and open finance.

At the top of the agenda were AI and generative AI (GenAI) — an obvious choice, given these disruptive technologies are on everyone’s lips and offer groundbreaking new opportunities for the financial sector. The second key focus of the evening was on open finance and multibanking, particularly regarding the benefits for banks and customers.

Ready for the AI revolution?

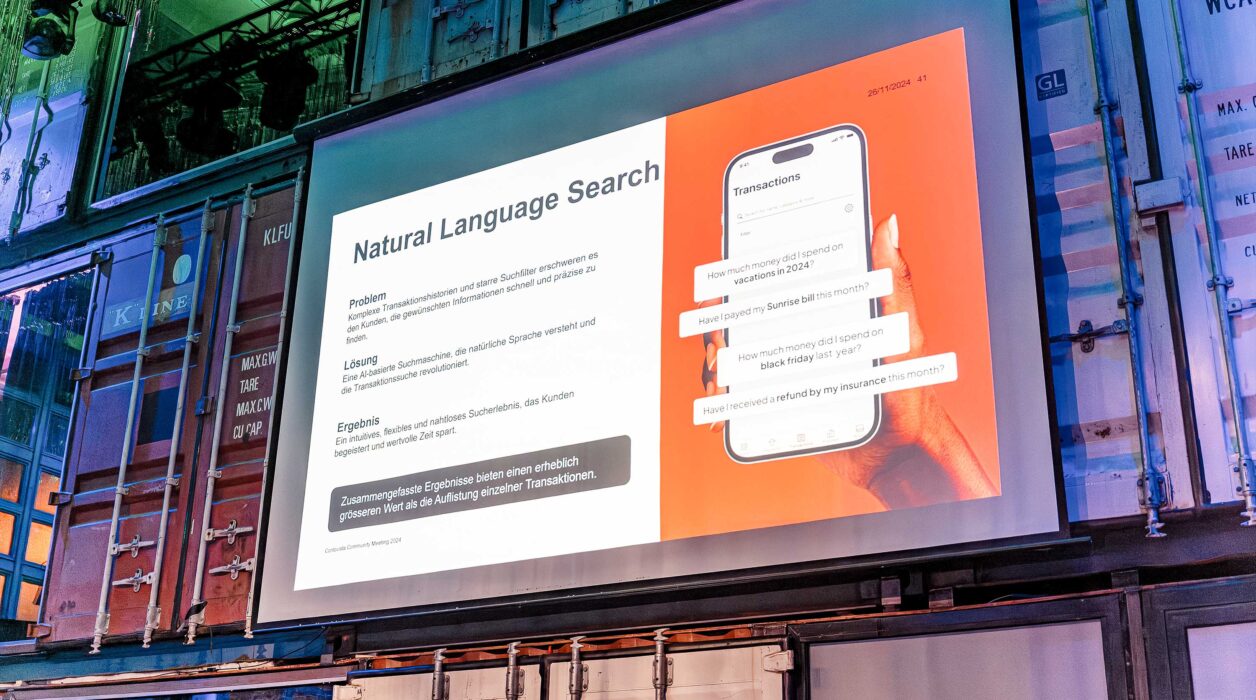

The evening kicked off with an inspiring keynote from entrepreneur and senior executive Blaise Poulet. He posed the important question of whether the financial sector is sufficiently prepared for the new elephant in the room, namely AI. A key success factor here is effective data management, which includes the aggregation of all transaction data, comprehensive indexing, as well as powerful search and analytics capabilities.

Using GenAI – with customised apps

Apps are an excellent way for financial institutions to drive banking forward with AI and GenAI. Ansuya Ahluwalia (CTO, Thirty3) demonstrated how companies can develop GenAI apps quickly, cost-effectively, and securely. She presented an innovative solution from ues.io, a no-code/pro-code platform for the rapid development of apps, including GenAI applications. Thanks to templates, AI support, and simple workflows, the entire process from concept to production can be completed in just a few hours.

Better customer relationships with AI

What GenAI capabilities specifically mean for strengthening customer relationships was demonstrated by Vuk Vegezzi (Partner & Consulting Lead, Visium) and Karthigan Sinnathamby (Engagement Manager, Visium). They presented two use cases that have a significant impact on both customer experience and efficiency: the intelligent call center with conversational AI and a decision engine, and intelligent document automation, such as when opening an account.

Vuk and Karthigan also provided a highly relevant outlook on the next stage of AI: Agentic AI, i.e. systems that not only produce content or answer questions like AI chatbots but also perform activities autonomously and adaptively. In the future, industry-specific multi-agent environments could handle complex banking processes and significantly enhance the customer experience.

Valiant: Open finance in practice

Christoph Wille from Valiant (Head of Customer Services & Products) then presented the “Multibanking” use case and demonstrated how the seamless integration with bLink and Contovista is already being implemented for business customers at Valiant. He also provided an outlook on implementing multibanking for private customers, which is about to launch for both mobile and e-banking at Valiant. At the end of the presentation, Christoph addressed other key points, explaining the value add of open finance for Valiant and its customers, as well as the key success factors for open finance use cases.

From the community, for the community

Béatrice Fink (CFO, b-rayZ) gave an inspiring presentation on using AI in medicine, explaining how AI can significantly optimise early detection of breast cancer. The b-rayZ application enhances diagnosis, supports patient management, and strengthens hospital compliance. What’s more, the technology increases efficiency and productivity, freeing up valuable capacity for treatment.

Elevator Pitches: Synpulse & netcetera

The Contovista partners Synpulse and netcetera concluded the engaging presentations with a new format at the Community Meeting — short portraits. Using elevator pitches, they quickly highlighted their use cases: Thomas Lusti (Principal Product Owner, Synpulse) presented approaches for strategic consulting and support for open finance and multibanking. Matthias Häfner (Head of Digital Retail Banking, netcetera) showed how deep integration contributes to an excellent customer experience. His example was the integration of Contovista’s Personal Finance Manager (PFM) into Finnova’s web and mobile banking.

However, the Community Meeting didn’t end there. It was followed by an extended apéro with opportunities for networking, where participants could further discuss and delve deeper into these topics — a wonderful conclusion to this thoroughly successful event.