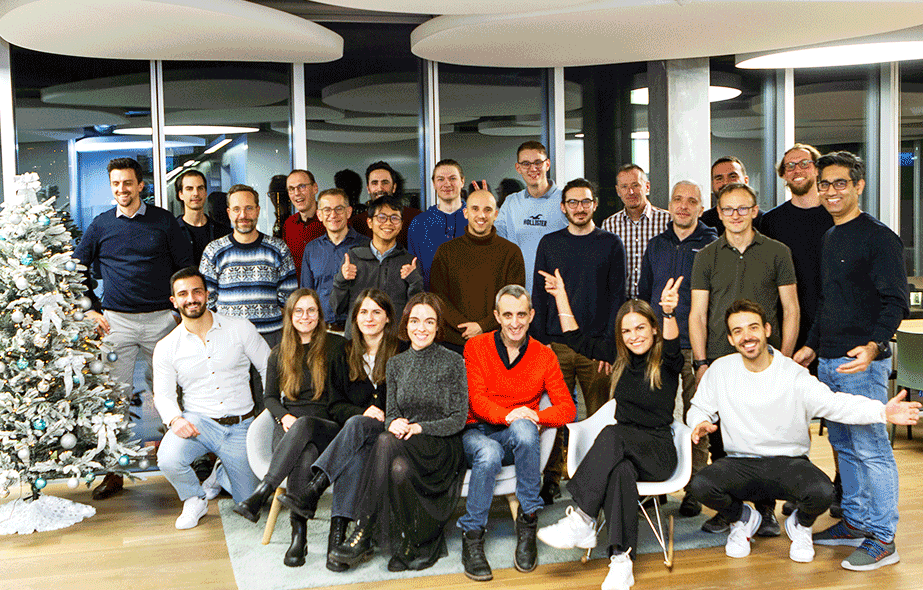

We are Contovista

We shape the financial industry into a seamless and secure ecosystem to unlock its full potential.

We shape the financial industry into a seamless and secure ecosystem to unlock its full potential.

We make banking relevant

Contovista has been developing data-driven white label banking solutions since 2013. We unlock the power of data to facilitate seamless user journeys and help financial service providers create unique customer value.

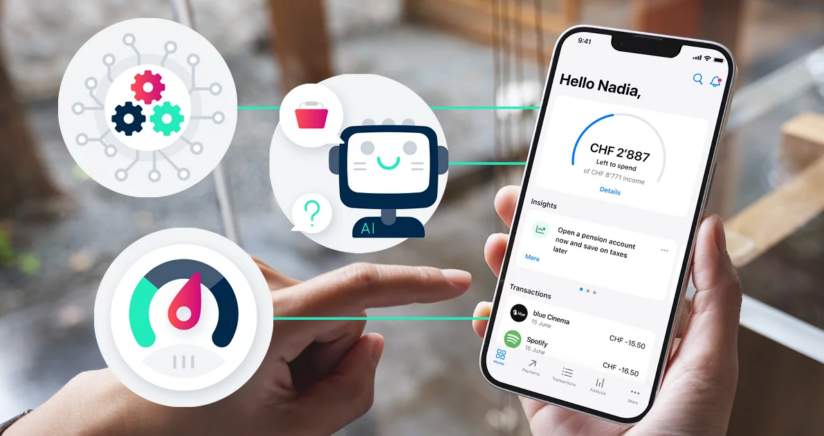

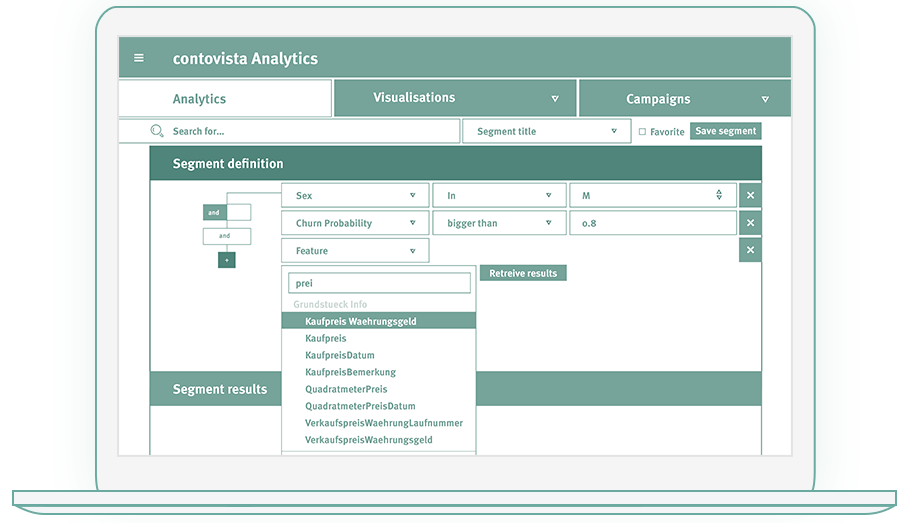

In doing so, we combine our unmatched expertise in aggregating, structuring and enriching data with a profound understanding of the financial industry and a strong track record in compliance. Today, we are the market leader in Switzerland with our AI Finance Manager for private clients (Personal Finance Manager) and SMEs (Business Finance Manager) as well as our data analytics solution for transaction data enrichment (Enrichment Engine) for financial institutions.

Our mission: data-driven banking

We develop AI Finance Management and Data Analytics solutions that help financial services providers make better use of transaction data to create relevant and hyper-personalised digital banking experiences for their customers. Our goal is to pave the way for the future of the financial industry through secure data integration and analytics and to unlock the power of data through AI. In this way, we help the financal industry to better understand their customers and defend their customer interface.

Contovista is the data-driven banking unit of Finnova AG. Finnova stands for innovative banking solutions – in development, operation and consulting – with a focus on digital transformation and open banking.